The Honolulu Board of Realtors® reported that market conditions in August indicate the upward trend in prices is slowing, sales activity is declining, and active inventory is rising. Here is a summary:

- After 19 consecutive months of double-digit increases in the monthly year-over-year median sales price of a single-family home on Oahu, August stats reported the slowest MSP growth since December 2020 — of 7.2%.

- The MSP of a condo on Oahu dipped under $500,000 for the first time since February 2022.

- Active inventory of single-family homes on the island was up more than 35% for a fifth consecutive month.

- Most regions across Oahu experienced a dip in single-family home sales volume.

- By the end of August, 13% of the newly-listed properties had price reductions, compared to 4% in August 2021.

- The Ewa Plain region accounted for 23% of August price reductions, followed by Diamond Head at 12%, Metro Honolulu at 11%, and Kailua at 10%.

This market swing is likely good news for buyers who have been hampered by bidding wars and limited inventory. But higher mortgage interest rates may continue to challenge buyers.

“Since the pandemic began, we have seen some of the most unusual market conditions we’ve ever seen — in some ways, defying conventional wisdom,” says Mike James, president of Coldwell Banker Realty. “But opportunities still exist for buyers and sellers, especially those with a real estate professional by their side to help navigate the shifts and challenges.”

While most regions on Oahu reported a dip in single-family home sales, the most significant drop in closings was in Kaneohe, where sales were off 57.8%, and in the Ewa Plain where sales dropped 35.2%. However, a few neighborhoods reported an increase in sales volume from a year ago, including Central Oahu, Hawaii Kai, and Makakilo.

The condo market saw sales decline across all price points and in some neighborhoods. The Metro area was hit the hardest with a 28.8% decrease in sales from a year ago, followed by Kaneohe, which dropped 42.9%, Central Oahu, down 25%, and the Ewa Plain, which fell 16.9%.

Bright spots for buyers:

- Homes are finally selling for under asking price. According to HBR’s recent report, nearly half — 48.7% — of single-family homes closed below the original asking price compared to 22.8% a year ago.

- Homebuyers have more choices. Single-family home inventory is up 43.3%, and condo inventory is up 12.9% from a year ago.

- Competition is easing. With fewer buyers who, despite higher mortgage interest rates still qualify for a loan, there likely will be fewer bidding wars.

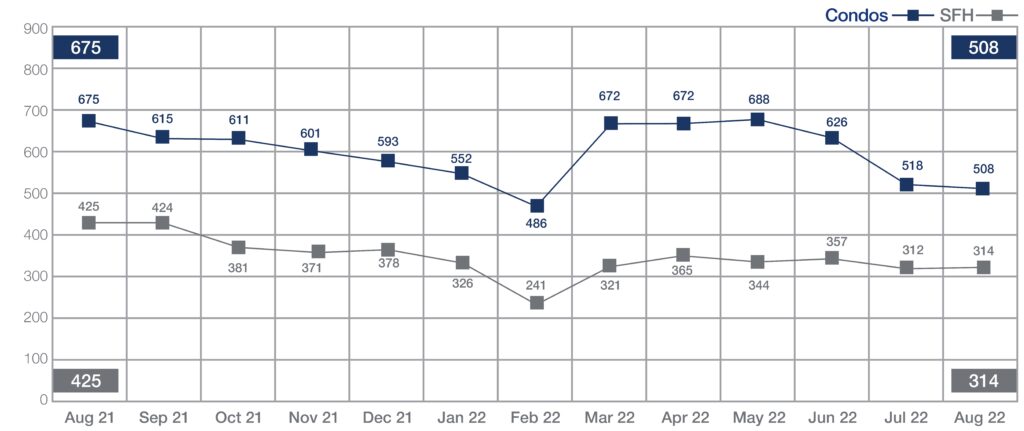

Sales of Single-Family Homes and Condos | August 2022

Source: Honolulu Board of REALTORS®, compiled from MLS data

Island-wide, single-family home sales volume dropped 26.1% from August 2021 — from 425 a year ago, to 314 last month. Year-to-date sales volume is down 13.2% — with 2,972 homes closed during the first eight months of 2021, compared to 2,580 at the end of August for 2022.

Condo sales volume dropped 24.7% from August 2021 — from 675 units that closed a year ago, to 508 last month. Year-to-date, the number of closings was relatively unchanged — down only 1.3%, from 4,783 for the first eight months of 2021 to 4,722 at the end of August.

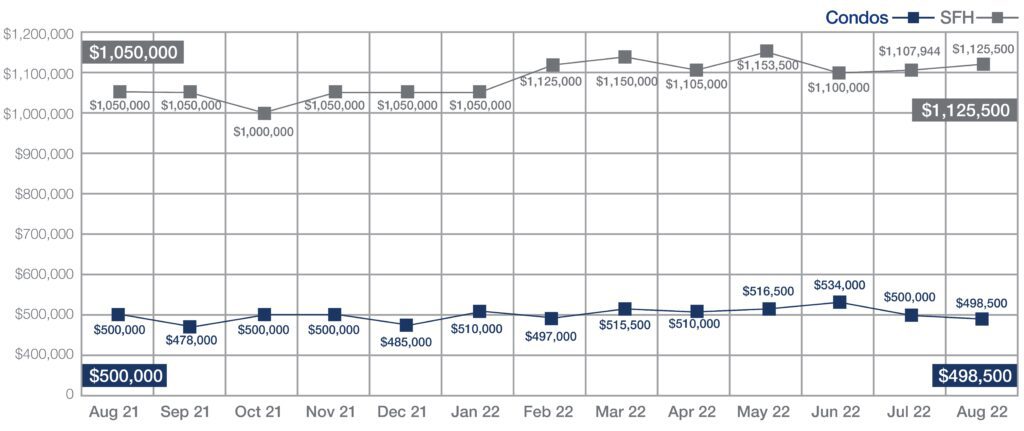

Median Sales Price of Single-Family Homes and Condos | August 2022

Source: Honolulu Board of REALTORS®, compiled from MLS data

Despite the market conditions pointing to a slowdown, the median sale price for a single-family home was up again, for the 13th consecutive month in August, though the rate of increase has slipped. A year ago, the MSP for SF was 1,050,000, and last month was up 7.2% to $1,125,500. The year-to-date stats for SF home MSP is even more impressive. In August 2021, the MSP after eight months was $960,000. This year, the median for that same time frame is $1,113,500 — up 16%.

The MSP for condos on Oahu is also holding steady. The condo MSP in August 2021 was $500,000, and last month, it dropped 0.3% to $498,500. Year-to-date, however, condo prices are up 9.7% from $465,000 in 2021, to $510,000 at the end of August.

In the condo market, price reductions were not as frequent as in the single-family home market, with 8% of newly listed condos undergoing a price reduction by the end of the month, compared to 3% last August. However, of the total active condo inventory, 34% of the units’ price was reduced at some point, compared to only 21% of the total inventory with reduced prices in August 2021.

NEIGHBORHOOD MARKET STANDOUTS

The market is slowing, evident by this month’s statistics from the HBR. But there are still neighborhoods where sellers get more than their asking price. Check out this list of sizzling HOT neighborhoods.

| SF | Percentage of Original List Price Received |

| Hawaii Kai* | 100.6% |

| Kailua-Waimanalo* | 100.2% |

| Kaneohe | 101.5% |

| Kapahulu-Diamond Head | 101.8% |

| Mahaha-Nanakuli | 101.1% |

| Makiki-Moiliili | 101.2% |

| Mililani * | 100.7% |

| Pearl City-Aiea * | 101.0% |

| Wahiawa * | 101.4% |

| Waipahu * | 102.2% |

| Condos | Percentage of Original List Price Received |

| Hawaii Kai* | 100.1% |

| Kailua-Waimanalo* | 102.3% |

| Makakilo | 100.4% |

| Mililani * | 102.3% |

| Pearl City-Aiea * | 101.4% |

| Wahiawa * | 104.6% |

| Waipahu * | 101.0% |

*Indicates this neighborhood is on the SF and condo list

To find out the MSP for your neighborhood, ask your Coldwell Banker Realtor®.

SOURCE: Honolulu Board of REALTORS®, compiled from MLS data.

Leave A Comment