Inventory of Oahu homes and condos for sale increased in October according to active listings figures recently released by the Honolulu Board of Realtors, offering buyers more options. The number of sales has reportedly eased its brisk pace, which may equate to less competition among buyers. And the stats also report an increase of days on the market, giving homebuyers more time to see those homes.

Despite stats that may indicate a softening market, the desire to own real estate on Oahu persists.

Rising interest rates may be a strong motive for both buyers and sellers.

The correlation between the shrinking sales volume and rising mortgage interest rates is evident. According to Freddie Mac, the national average interest rate for a 30-year fixed rate loan in September 2017 was 3.83%. A year later, in September 2018, the same 30-year fixed rate loan cost 4.65%. In October, rates inched up again to 4.85%, an increase of more than 1 percentage point in 13 months.

“Mortgage interest rates began to increase in November 2017,” says Kalama Kim, principal broker at Coldwell Banker Pacific Properties. “While there was no immediate effect, a year later the number of closed sales has slowed significantly. Interest rates combined with climbing home prices have pushed affordability higher and may have stalled the real estate market.”

Still, sub-5% interest rates are motivation for those buyers and sellers on the fence to move before rates go higher. It was April 2009 when 30-year fixed rate mortgage interest rates first dropped below 5%, and rates have not been above 5% since February 2011. Long expected, rates are finally heading upward and is a new reality. Yet, according to Kim, there are still some upsides to this change in the market cycle.

“For sellers, we are still seeing homes that are priced right accepting offers in less than three weeks. For buyers planning to live in the home, paying toward your equity to build wealth for the future is still better than paying a landlord’s mortgage. And it still makes sense to use the bank’s money to grow your equity. Historical trends show that Hawaii’s home values will continue to increase through each market cycle.”

Every 1% increase in interest rates is the equivalent of a 10% increase in price. Or for a buyer, a 10% decrease in the maximum loan amount they may qualify for. That’s significant. The remainder of 2018 a great time to buy or sell. Don’t wait.

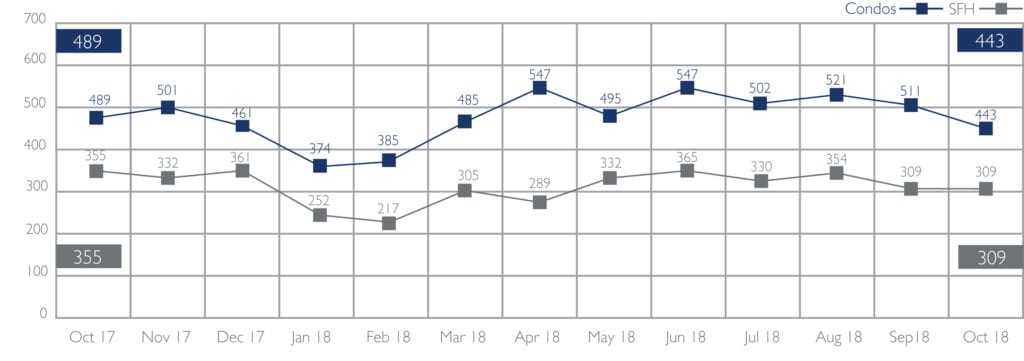

Sales of Single-Family Homes and Condos | October 2018

Source: Honolulu Board of REALTORS®, compiled from MLS data

October closed sales of single-family homes dropped 13% — from 355 homes sold in October 2017 to 309 homes last month. Year-to-date, the overall number of closed sales is down 4.8%.

In fact, October marked the sixth consecutive month of decreased sales volume. The last month that sales volume on Oahu was reported to be up was April.

Condominium sales volume is also down 9.4% — from 489 condos closed in October a year ago, to 443 closed sales last month. The number of closed sales after the first ten months of 2018 as compared with the same time frame in 2017, is running very close — down 1.1% from 4,862 to 4,810 condo closings.

Six straight months of declining sales, along with a concurrent decline in pending sales indicate the Oahu market is softening. Other stats — rising inventory, and an increase in days on the market — are also weakening market trends.

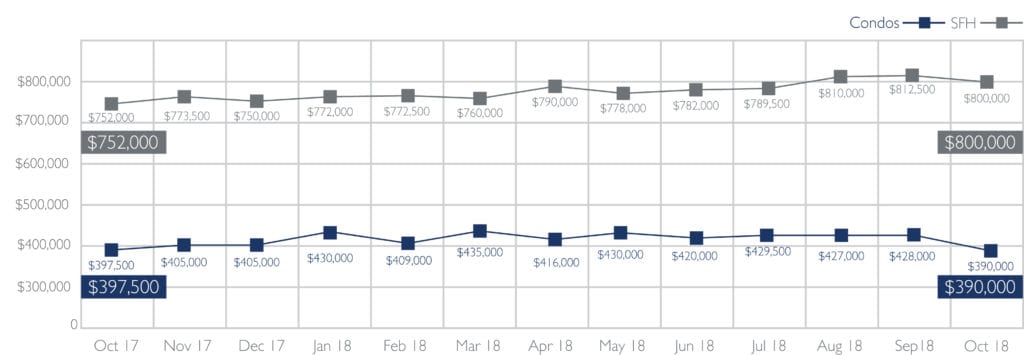

Median Sales Price of Single-Family Homes and Condos | October 2018

Source: Honolulu Board of REALTORS®, compiled from MLS data

Despite the shrinking demand and the corresponding rise in supply, the sales prices of single-family homes continue to sustain their value with October’s median sales price for a single-family home at $800,000 for the third month running. Year-to-date, the median price of a single-family is up 4.6% from 2017.

Condo median prices on Oahu are down 1.9%, however. October MSP was $390,000, down from $397,500 during the same timeframe in 2017 — offering some relief for condo buyers and out-priced single-family home buyers. Year-to-date, condo prices gained 3.5% — from $405,000 after the first ten months of 2017, to $419,000 by the end of October.

HOT MARKETS!

Sellers who closed in October had reason to be happy. Sales averaged very close to 100% of the asking prices. Single-family homes commanded an average of 97% of the original list price, with condos nearly as gainful at 97.7% of the original list price.

Keeping in mind the summer’s price surge, prospective sellers need to closely examine unique trends in their own neighborhood before deciding upon a list price. For the best analytical advice, talk with one of our experienced agents at Coldwell Banker Pacific Properties to help you get the most value for your home.

This month’s hot markets are those neighborhoods where —year-to-date — homes consistently closed at 99% or more of the original list price.*

| Single-family homes in: | |

| Downtown – Nuuanu | 99.1% |

| Ewa Plain | 99.1% |

| Makakilo | 99.5% |

| Mililani | 99.4% |

| Moanalua – Salt Lake | 100.1% |

| Waipahu | 100.1% |

|

|

|

| Condos in: | |

| Downtown – Nuuanu | 99.0% |

| Ewa Plain | 99.3% |

| Kaneohe | 99.8% |

| Kapahulu – Diamond Head | 99.6% |

| Mililani | 99.5% |

*Honolulu Board of REALTORS®, MLS Data, – September 2018

Leave A Comment