With double-digit increase in active inventory since September, the pace of Oahu’s market has slowed noticeably. This shift in market dynamics represents a move toward a more balanced market and offers a ray of hope for buyers who have been frustrated by low inventory and competitive bidding wars. And there is still good news for sellers as prices remain on firm ground.

“Buyers are certainly benefitting from the shifting market,” says Kalama Kim, principal broker at Coldwell Banker Pacific Properties. “They have more choices evidenced by an increase in active inventory — 28% more single-family homes for sale and 14% more condos as compared to last year.”

According to the Honolulu Board of Realtors, the number of active listings has been bumping up since March — with double-digit increases in five of the last six months.

“The steady increase of inventory has allowed Buyers time and leverage to negotiate a lower price. Last month Buyers who purchased a home paid just 96.9% of the asking price to get the home of their choice.”

The months of remaining inventory stat is the measure that best reflects how demand is affecting our market. It measures how long it would take sell out all the properties on the market given the current level of demand if no other homes came on the market for sale. Last month the number jumped to 3.1 months representing a 40.9% increase. “When Months Remaining Inventory is between 3-6 months it represents a balanced market. Not too hot and not too cold,” says Kim.

Buyers who are in the market and are actively looking for a property to purchase also have the luxury of seeing all the properties on the market before they make their choice. This is a great benefit because they don’t have to rush into this major decision. The single-family home Median Days on Market of 28 days before a Seller accepts an offer on their home illustrates how buyers are taking their time. That figure was 16 days just one year ago. However, Kim explains that that may not be bad for seller’s either. “While it takes a bit longer to sell a property in today’s real estate market, Seller’s committed to doing so can still sell their home in less than a month and move on to their next home.”

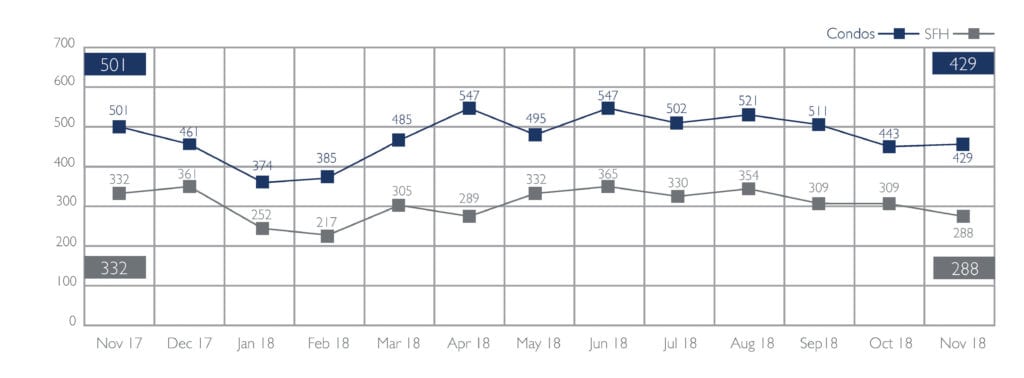

Sales of Single-Family Homes and Condos | November 2018

Source: Honolulu Board of REALTORS®, compiled from MLS data

November sales volume decreased, year over year. Single-family homes closed last month fell 13.3% — from 332 closings in November 2017 to 288 last month. Condo sales were fewer as well — down 14.4% year over year — from 501 units closed in November 2017 to 429 last month.

Year-to-date figures show sales volume for the first 11 months of the year decelerating as well.

A tally of closed sales for the first 11 months indicate single-family home sales were down 5.6%, and condo sales were down 2.3% from the same period in 2017.

While it’s been a year since mortgage interest rates started to climb, it is unclear what the direct effect will be on the local market. However, Kim notes that “many buyers have felt the increase in rates in the form of affordability. Increasing rates means that buyers can qualify for a lower amount.”

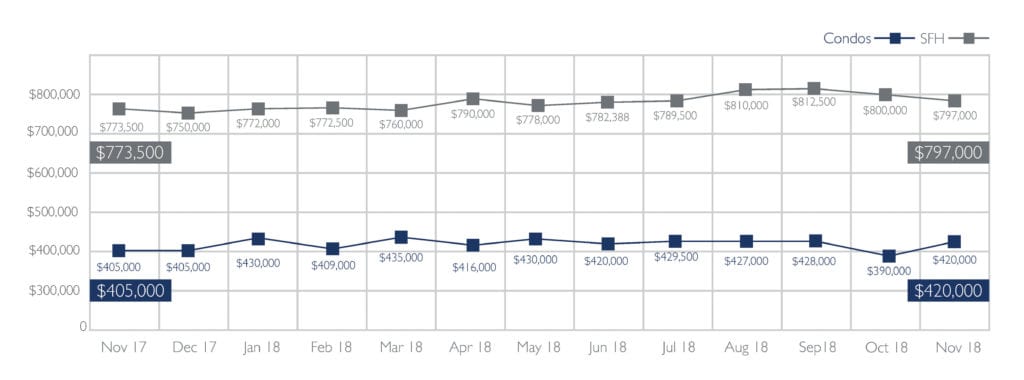

Median Sales Price of Single-Family Homes and Condos | November 2018

Source: Honolulu Board of REALTORS®, compiled from MLS data

Despite indicators that may point to a softening market — increase in inventory (supply) and a decrease in sales (demand) — prices continue upward.

The Honolulu Board of Realtors reports the median sales price of a single-family home was up 3% in November — from $773,500 in November 2017 to $797,000 last month. Indeed, the price of a single-family home is up in all but one month since April 2017, and on a steady climb — up 4.2% — since January.

Condo prices are up 3.7% from 2017 figures — to $420,000, representing a 4.9% climb, year-to-date.

With one month to go until the year end, the median sales price is poised for a record high.

HOT MARKETS!

Year-to-date Median Sales Prices of homes and condos were up this year 4.2% and 4.9% respectively. There were a few neighborhoods, where the year-to-date increase in MSP was greater than 10%. These are this month’s hot markets.

*Both SF and Condo prices rose more than 10%.

| Single-family homes in: MSP Increase | |

| Aina Haina – Kuliouou | 25% |

| Ala Moana – Kakaako * | 15% |

| Downtown – Nuuanu * | 13% |

| Makiki – Moiliili | 11% |

|

|

|

| Condos in: MSP Increase | |

| Ala Moana – Kakaako * | 13% |

| Downtown – Nuuanu * | 19% |

| Kailua – Waimanalo | 24% |

| Kalihi – Palama | 11% |

| Kapahulu – Diamond Head | 11% |

| North Shore | 10% |

*Honolulu Board of REALTORS®, MLS Data, – October 2018

Leave A Comment