In September, the Federal Reserve cut its benchmark interest rate by half a percentage point — the first such cut since 2020 — and may precede another rate cut later this year, which could domino into even lower mortgage rates in 2025.

First Hawaii Bank currently offers 30-year fixed-rate mortgages for 6.0%, and 15-year, fixed-rate loans for 5.250%. Adjustable-rate loans are also available for as low as 5%.

“We believe these lower rates will attract more buyers and sellers who were waiting for a better market,” says Mike James, president of Coldwell Banker Realty. “Lower rates significantly enhance affordability, allowing buyers to purchase homes that were previously out of reach. This increased borrowing power means more opportunities for buyers and a more dynamic market for sellers. Now is an excellent time to take advantage of these favorable conditions.”

Sales volume dipped slightly in both single-family and condo segments, but the year-to-date figures showed an increase in single-family sales volume. Third-quarter SF sales were up 5.8% from this time last year.

Pending sales/contract signings rose in both segments. With single-family-home pending sales up 16.8% from 232 homes still in escrow in September 2023 to 271 homes pending last month. Pending condo sales were also up 7.5%, from 371 a year ago, to 399 last month.

The Honolulu Board of Realtors® noted that both single-family and condo segments alike experienced a slight decrease in sales that closed above the original asking price. Last month, 29% of single-family homes sold for more than the original asking price, compared to 38% in September 2023. Similarly, a smaller share of condos sold above the asking price, dropping to 15% compared to 20% a year ago.

Notably, active inventory skyrocketed — up 27.5% for single-family homes and up 58% for condos. At the end of the third quarter, there were 755 available SF listings and 1,887 condo listings. Ample inventory offers buyers a wide choice while attractive mortgage rates increases affordability.

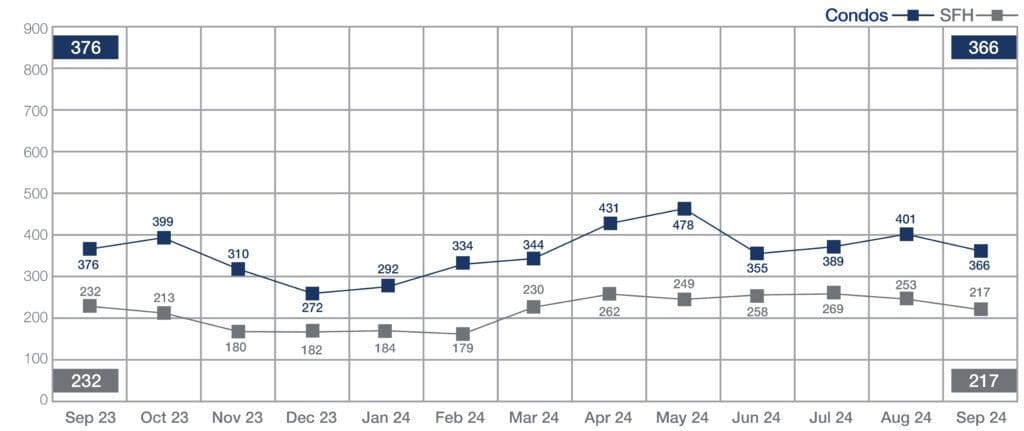

Sales of Single-Family Homes and Condos | September 2024

Source: Honolulu Board of REALTORS®, compiled from MLS data

Single-family sales were down 6.5% — from 232 in September 2023 to 217 homes closed last month. Condo volume was down 2.7% — from 376 sales in September 2023 to 366 last month.

For year-to-date volume through the end of the third quarter, single-family home sales were up 5.8% — from 1,985 during the same period in 2023 to 2,101 sales during the first nine months of 2024.

Conversely, year-to-date condo volume dropped 5.6%, from 3,592 sales a year ago, to 3,390 by the end of October.

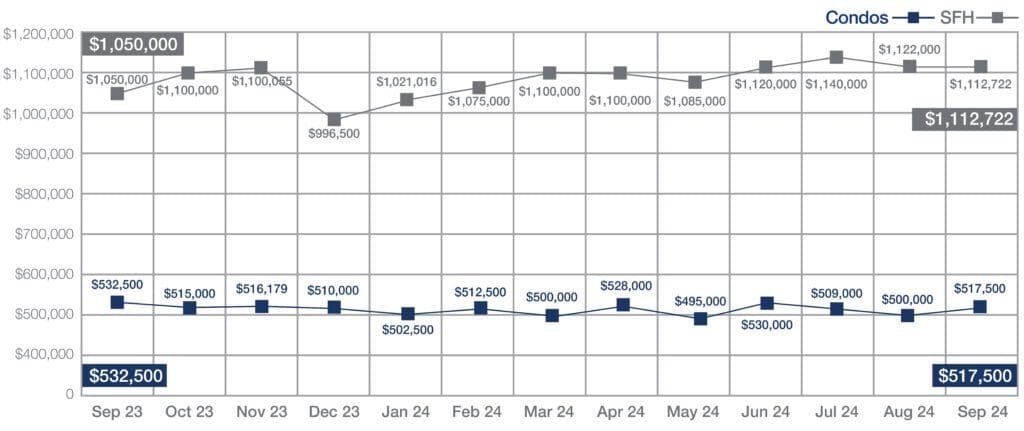

Median Sales Price of Single-Family Homes and Condos | September 2024

Source: Honolulu Board of REALTORS®, compiled from MLS data

For September, the median price of a single-family home increased by 6% to $1,112,722 from $1,050,000 in September 2023. The median price of a condo dropped 2.8% to $517,500 from $532,500 in 2023.

Year-to-date, MSP of a SF home is up 4.8% to $1,100,000 from $1,050,000 in September 2023. YTD condo MSP is up 1%, from $505,000 in 2023 to $510,000 last month.

MARKET SPOTLIGHT

This month’s spotlight is on Oahu’s more affordable neighborhoods. Specifically, where homes and condos remain near or below Oahu’s median sales prices. Check it out.

| Median Sales Price | ||

| Single Family | Year-To-Date

(AUG 2024) |

Year-To-Date

(AUG 2023) |

| Ewa Plain | $890,000 | $898,500 |

| Kalihi – Palama | $910,000 | $905,000 |

| Makaha – Nanakuli | $655,000 | $675,000 |

| Wahiawa | $825,000 | $840,000 |

| Waipahu | $950,000 | $915,000 |

| Windward Coast | $995,000 | $1,150,000 |

| Median Sales Price | ||

| Condo | Year-To-Date

(AUG 2024) |

Year-To-Date

(AUG 2023) |

| Kalihi – Palama | $399,888 | $400,000 |

| Makaha – Nanakuli | $245,000 | $250,000 |

| Makiki – Moiliili | $400,000 | $405,000 |

| Moanalua – Salt Lake | $430,000 | $435,000 |

| Pearl City – Aiea | $481,500 | $467,500 |

| Wahiawa | $345,000 | $324,000 |

| Waikiki | $430,000 | $418,500 |

| Windward Coast | $354,950 | $155,000 |

SOURCE: Honolulu Board of REALTORS®, compiled from MLS data.

For an up-to-date market analysis of your property, contact Coldwell Banker Realty today. We are happy to provide you with a current valuation on your home.