Oʻahu’s housing market showed signs of renewed activity in June, with a modest increase in sales and continued growth in inventory—giving buyers more options and greater negotiating power.

More sellers are entering the market, contributing to the growing inventory. New listings for single-family homes jumped 19.2% year-over-year, while condo listings rose 7.9%. Active inventory also remains elevated, with 861 single-family homes and 2,542 condos on the market—up 31.9% and 47% respectively from a year ago.

“Buyers today are navigating a market with more options and more time to make decisions,” said Mike James, president of Coldwell Banker Realty. “That’s a significant shift from the fast-paced environment we saw just a couple of years ago. With inventory rising and price adjustments becoming more common, especially in the condo segment, buyers are in a stronger position to find the right fit.”

Sales activity was strongest in the mid-range price points. Single-family homes priced between $800,000 and $1,099,999 saw a 28.2% increase in sales. In the Ewa Plain region, pending sales surged 44.4%, reflecting renewed buyer interest. Condo buyers were most active in the $100,000 to $699,999 range, which accounted for 259 sales—an 11.2% increase from June 2024. Pending condo sales also rose sharply in Hawaii Kai, Waipahu, and Ewa Plain.

With more inventory and a more deliberate pace among buyers, homes are spending longer on the market. In June, the median days on market rose to 24 days for single-family homes and 40 days for condos—about one to two weeks longer than a year ago. Only a few regions, including Hawaii Kai, Kailua, Kaneohe, and Waipahu, saw condos selling in under 30 days.

Affordability remains a key concern, particularly in the condominium segment, where 42% of active listings in June showed price reductions. In response to rising insurance costs and limited coverage options, a new state law may offer some relief. On July 7, Governor Josh Green signed Senate Bill 1044 into law as Act 296, aimed at stabilizing the condo insurance market.

The legislation reactivates the Hawai‘i Hurricane Relief Fund to provide hurricane coverage for condo associations that have been denied insurance, and establishes a low-interest loan program to help aging buildings complete critical repairs that impact insurability. The bill was developed in the wake of the 2023 Maui wildfires, which caused $13 billion in damage and led to $3 billion in insurance payouts, prompting many insurers to exit the market.

Governor Green described the law as a step toward restoring stability. Already, 80 condo associations have applied for repair loans, with 10 approved since the program opened in late June.

The hope is that Act 296 will encourage insurers to return to the market and offer more competitive rates—especially for older, mid-range condo buildings that house many local residents.

For more information on the new law and relief programs, visit hhrf.hawaii.gov. Source: Honolulu Star-Advertiser, July 8, 2025

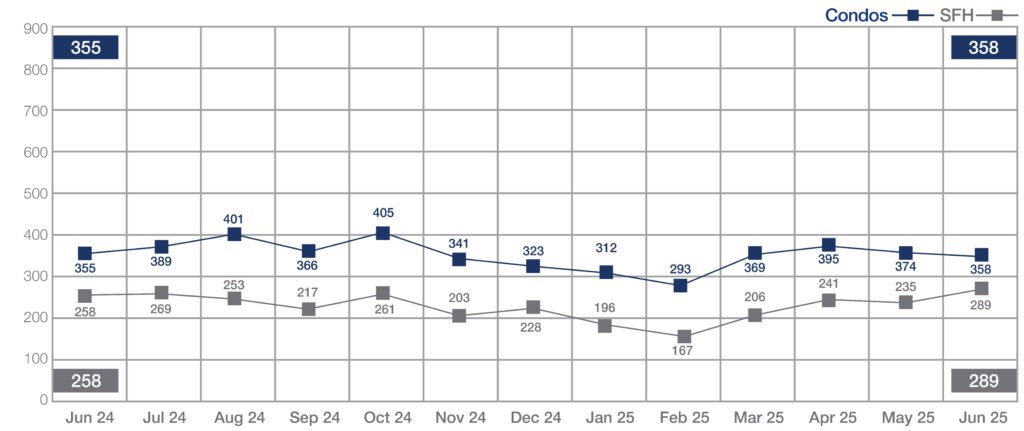

Sales of Single-Family Homes and Condos | June 2025

Source: Honolulu Board of REALTORS®, compiled from MLS data

Oʻahu’s housing market saw a modest lift in June, with single-family home sales rising 12% year-over-year, from 258 in June 2024 to 289 this year. Despite the monthly gain, year-to-date sales remain slightly behind last year’s pace, down 2.1% with 1,334 homes sold in the first half of 2025 compared to 1,362 in the same period last year.

Condominium sales were relatively flat, up just 0.8% year-over-year, with 358 units sold in June 2025 compared to 355 in June 2024. However, year-to-date condo sales show a more noticeable decline—down 6% from 2,234 units in the first half of 2024 to 2,101 this year.

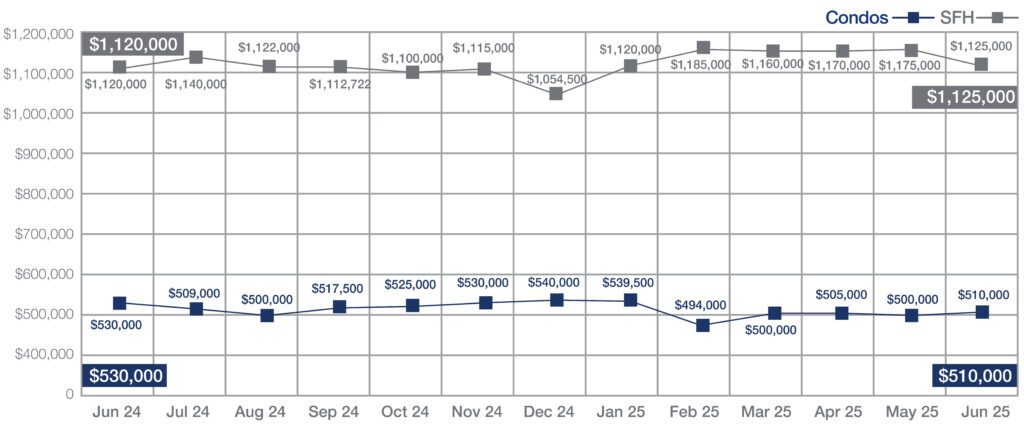

Median Sales Price of Single-Family Homes and Condos | June 2025

Source: Honolulu Board of REALTORS®, compiled from MLS data

The median sales price of a single-family home in June 2025 was $1,125,000, a slight 0.4% increase from $1,120,000 in June 2024. Year-to-date, the median price stands at $1,150,000—up 6% from $1,085,000 in the first half of 2024.

In contrast, condominium prices dipped. The median sales price in June 2025 was $510,000, down 3.8% from $530,000 a year ago. Year-to-date, the condo median price is $507,250, a slight 0.5% decrease from $510,000 in the same period last year.

MARKET SPOTLIGHT

This month, we spotlight the most affordable Oahu neighborhoods. If you’re wondering where single-family homes are selling for under $1 million, and condos are selling for under $500,000, here’s the scoop. Happy hunting.

| Median Sales Price | ||

| Single Family | Year-To-Date | Year-To-Date |

| May 2025 | May 2024 | |

| Ewa Plain | $930,000 | $877,500 |

| Makaha – Nanakuli | $635,000 | $660,000 |

| Wahiawa | $830,000 | $827,500 |

| Waipahu | $957,500 | $950,000 |

| Median Sales Price | ||

| Condo | Year-To-Date | Year-To-Date |

| May 2025 | May 2024 | |

| Kalihi – Palama | $385,000 | $390,000 |

| Makaha – Nanakuli | $217,000 | $242,500 |

| Makiki – Moiliili | $375,000 | $405,000 |

| Moanalua – Salt Lake | $415,000 | $437,000 |

| Pearl City – Aiea | $465,000 | $460,000 |

| Wahiawa | $310,000 | $347,500 |

| Waikiki | $449,000 | $430,000 |

| Waipahu | $496,000 | $520,000 |

| Windward Coast | $365,000 | $465,000 |

For an up-to-date market analysis of your property, contact Coldwell Banker Realty today. We are happy to provide you with a current valuation on your home.

SOURCE: Honolulu Board of REALTORS®, compiled from MLS data.