After 13 consecutive months of rising prices, the median sales price of a single-family home dropped for the first time. The 1.6% year-over-year decline is only the fourth time in more than three years single-family home prices have taken a break from its otherwise upward climb.

Statistics from June, released this week by the Honolulu Board of Realtors, also show a slight slowdown in the sales of single-family homes. Yet, condominium sales volume, as well as median sales price are both up last month, when compared to June 2017.

“Sellers are still enjoying today’s market,” says Kalama Kim, broker in charge at Coldwell Banker Pacific Properties. “For those properties that sold last month and prior, sellers are accepting offers within three weeks from listing their property.”

All three inventory benchmarks — new listings, months of inventory remaining, and total active listings — show an increase last month when compared to June 2017. In fact, the number of active listings hit a two-year high in June for both single-family and condos.

The most dramatic surge in inventory are in single-family homes priced between $650,000 and $1.9 million.

“The increase in active inventory and new listings over the past few months is needed relief for buyers,” Kim adds. “Buyers may finally have multiple choices without having to compete with multiple buyers for the properties they are interested in buying. If the trend continues, the balance between supply and demand could benefit buyers and they may gain some of the negotiating leverage.”

Kim goes on to explain that despite the decline in pending sales, housing demand remains strong, as illustrated by heavy buyer traffic at open houses.

“Even though interest rates continue to creep up, current rates are still considered low, historically. For example, at the peak of the last market surge, interest rates for a 30-year mortgage were in the 6% range, compared to the 4.5% to 5% range we see today.”

That said, Kim points out how increases in interest rates can significantly affect how much a buyer can afford to spend — their purchase price and their monthly payment.

“Some buyers may be desperately trying to find the right home before interest rates rise higher and price them out of the market for the type of home they prefer,” Kim says.

With a few more months of summer to go, there are positive aspects for both buyers and sellers.

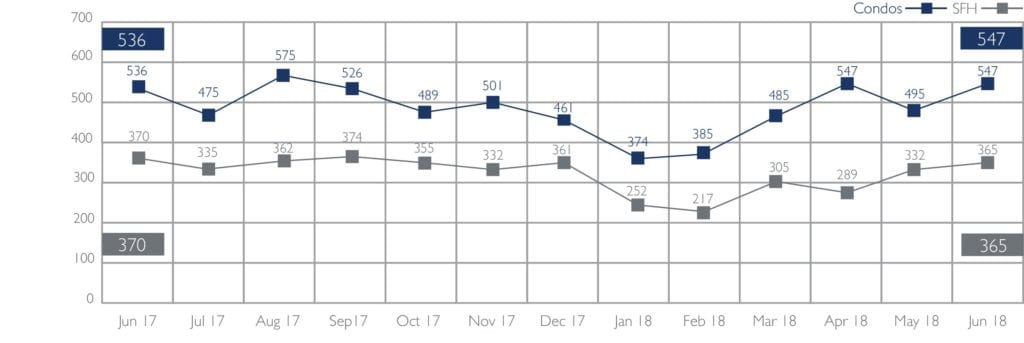

Sales of Single-Family Homes and Condos | June 2018

Source: Honolulu Board of REALTORS®, compiled from MLS data

While the year-over-year tally is very close, the number of single-family homes that sold in June, as compared with homes sold in the month of June 2017, is slightly down. Sales volume last month was 365 homes sold, compared to 370 a year ago.

Condo sales volume improved from the HBR stats from a year ago — closing on 547 condominiums in June, up from 2.1% the same month last year when 536 units closed.

At the half-year point, condo sales increased 6.5% (based on the number of closing for the first six months), while single-family sales volume decreased 1.6%.

The affordability of Oahu condominiums may explain the unwavering appeal of this market segment.

Median Sales Price of Single-Family Homes and Condos | June 2018

Source: Honolulu Board of REALTORS®, compiled from MLS data

The median price of a single-family home fell 1.6% in June, compared to the June 2017, which was the highest one-month MSP on record at $795,000. The MSP last month, $782,388, is the fourth highest, to date. ($786,250 in August 2017 and $790,000 in April 2018)

Yet, year-to-date tallies show the six-month MSP ahead of 2017 figures by 3.9% — from $750,000 at the six-month point in 2017 to $779,000 at the end of the second quarter 2018.

Condo prices were up again in June as well, marking the 12th consecutive month of price increases. The MSP of a condo ticked up 5%, from $400,000 a year ago to $420,000 in the last month. Year-to-date, the price of a condo unit is up 6.5%.

HOT MARKETS!

In June, the median number of days a home was on the market before an accepted contract was signed and escrow opened was up slightly from 12 days for a single-family home in June 2017 to 16 days; and from 13 days on the market for a condo in June 2017 to 18. But the most competitive markets are still sizzling, as we call out the island’s hottest markets — those that sold in 15 days or less, during the first five months of 2018.

Single-family homes selling in:

- Ewa Plain 13 days on the market

- Kapahulu – Diamond Head 13 days on the market

- Makakilo 13 days on the market

- Mililani 12 days on the market

- Moanalua – Salt Lake 8 days on the market

- Pearl City – Aiea 14 days on the market

- Wahiawa 12 days on the market

Condos selling in:

- Aina Haina – Kuliouou 8 days on the market

- Ewa Plain 12 days on the market

- Kaneohe 11 days on the market

- Makakilo 14 days on the market

- Mililani 11 days on the market

- Moanalua – Salt Lake 11 days on the market

- North Shore 14 days on the market

- Pearl City – Aiea 11 days on the market

- Wahiawa 10 days on the market

- Waipahu 11 days on the market

Leave A Comment